Industry analysis refers to the application of strategic management tools to a specific industry for determining the competitiveness and attractiveness of the industry. With this explanation, the importance of industry analysis in strategic management processes should be quite clear. The purpose of this is to answer one major business question: is this an attractive industry to be in?

Using this knowledge, companies can try and develop suitable strategies to overcome the threats in the industry and increase the competitive advantages of the company. This would in turn help ensure the long-term sustainability and profitability of the business.

If you stick with us until the end, we will fully explain what is included in industry analysis, what is its importance and how it can be applied in strategic management. We have also included a free industry analysis template with an example, which you can use to improve the presentation of your research.

Table of Contents

Purpose and objectives for doing an industry analysis audit

It is important to perform industry analysis before developing a business plan, as it allows the planner (i.e. the business or the market analyst) to decide on the best possible strategies that will ensure long-term survival of the company in the given industry, by considering specific industry components or ‘forces’.

The following are some objectives for which doing an industry analysis audit might be helpful.

- Identify the key industry drivers and determine how the industry is structured at present

- Analyze how the industry structure affects the profitability potential of the business

- Understand how different forces of the industry will drive competition in the future

- Leverage on the industry attractiveness factors when formulating business strategy

- Develop strategies that can re-shape the industry-structure and favor business growth

What is industry analysis in strategic management?

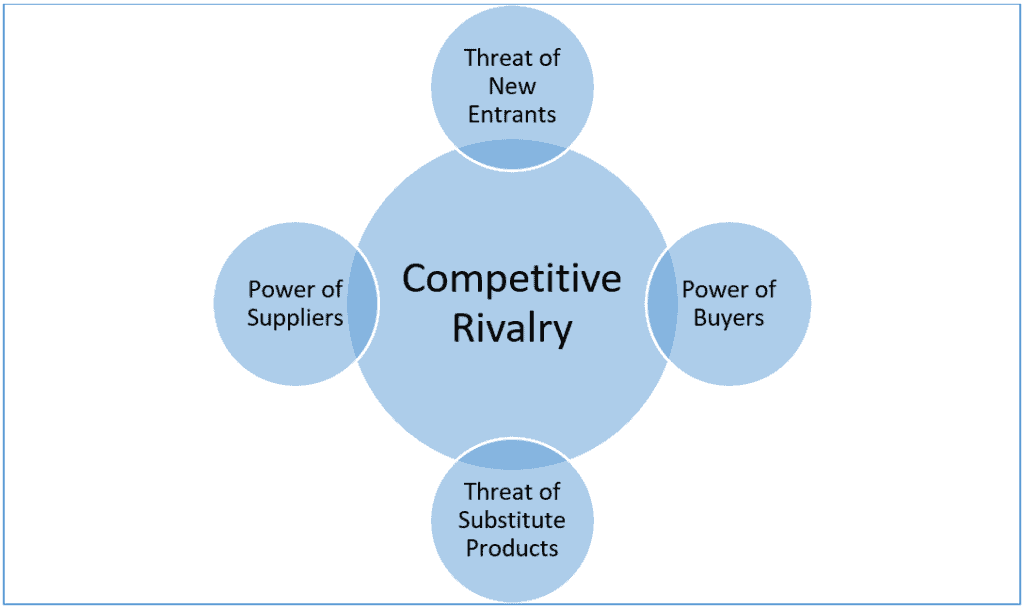

In strategic management, industry analysis draws from the work of Porter (1980) who suggests that there are five forces shaping an industry’s structure and driving the competition, which can be analyzed to determine the profitability potential of conducting business in the said industry. Porter (1980) claims that “the collective strength of the forces determines the ultimate profit potential in the industry”.

Porter’s (1980) five forces framework can be used as an industry analysis template to assess the industry attractiveness, for launching new businesses as well as for tweaking the strategies of existing businesses.

From a strategic perspective, the industry analysis forces as given by Porter (1980) are:

- Intensity of competitive rivalry in the industry

- Bargaining power of buyers in the industry

- Bargaining power of suppliers in the industry

- Level of threat of new entrants to the industry

- Level of threat of substitute products/ services

These forces are explained further below in the next sections, which can be applied for industry analysis in any order. However, from our experience coaching hundreds of students over the past decade, we have noticed that the practical application of the industry analysis template given by Porter (1980) through the five forces framework may be challenging to beginners, because of the lack of depth in their analysis as well as lack of strategic insight. That is why we recommend using our free in-depth industry analysis template, detailed in the “how to perform industry analysis” section below.

(Or you can generate the five forces graph of a single industry or even compare the attractiveness level of multiple industries of your choice – using our customizable and free industry attractiveness template)

What is industry analysis in a business plan?

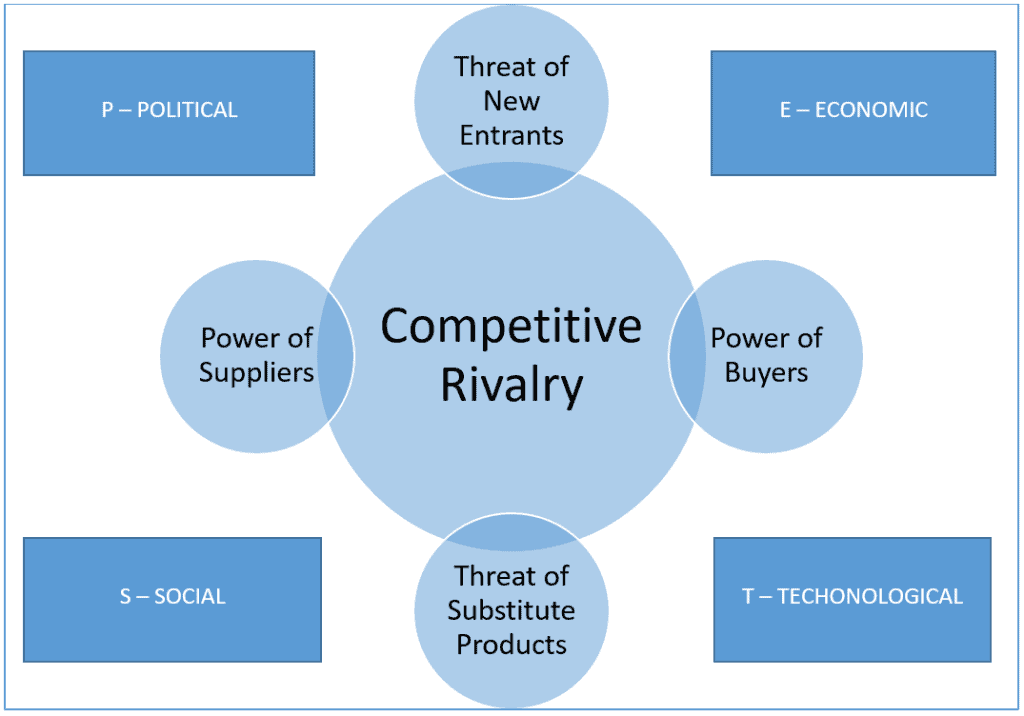

Although industry analysis relies heavily on Porter’s (1980) five forces framework, however, when developing a business plan, the industry must be analyzed holistically (i.e. the macro environment as a whole against the internal strengths/ weaknesses of the company). That is why business plans must draw from external environment analysis tools such as PEST or PESTLE frameworks, along with internal environment analysis tools such as SWOT or TOWS matrix, in addition to the use of Porter’s five forces framework as an industry analysis tool.

Here is an example of how to apply the PESTLE, SWOT and TOWS frameworks.

For a thorough business plan, the application of these tools must not stand alone, but instead, they should complement each other. For example, external environmental threats can be mitigated using internal strengths as well as by exploring the opportunities present within the industry structure.

Additionally, when developing a business plan, the downsides to Porter’s (1980) five forces framework for industry analysis must also be taken into consideration, so that the possibility of any shortcomings are not overlooked.

What are the limitations of Porter’s five forces model in industry analysis?

Some of the criticisms of Porter’s five forces framework, which reduce the meaningfulness of the model are listed below.

- In an economic sense, Porter’s five forces framework assumes the forces to act in a classic perfect market. However, in reality, the more regulated an industry is, the less meaningful insights for strategy can be gained from the model.

- Porter’s five forces model is best applicable for analyzing simple market structures, as comprehensive description and analysis of all five forces becomes difficult in complex industries with multiple interrelations, by-products and segments.

- Porter’s five forces assumes market structures to be relatively static, which is hardly the case in today’s dynamic markets. For instance, technological breakthroughs and dynamic market entrants from start-ups or other industries may completely change business models, entry barriers and relationships along the supply chain within short times, which will hardly provide meaningful advice for preventive actions.

- Porter’s five forces model is based on the idea of competition. That is, it assumes companies exert competitive advantages over one another in the markets and also over suppliers or customers. As such, it doesn’t really take into consideration the possibilities of business strategies like strategic alliances, electronic linking of information systems of all companies along a value chain, virtual enterprise-networks or other such collaborative strategies.

- Porter’s five forces doesn’t clearly consider other market and industry factors such as advancements in IT/Digitalization, unstable economy, government laws, globalization, customer expectations, environmental conditions, etc.

- Porter’s five forces relies heavily on external industry structure that are outside the operations of the company, while ignoring the internal capabilities, resources and assets of the firms, which differ from one firm to another. (Read more about this in our article exploring RBV – Resource-based view of strategy)

- There are situations in which a company is pushed towards an externally imposed strategy – this happens when the company is driven by strong environmental forces or factors. In such situations, the use of the five forces model may be restricted or skewed towards more towards some of the five forces.

What are the advantages of Porter’s five forces model in industry analysis?

- The key advantage of the Five Forces Model is ease of use. Using this model does not require technical skills or special training.

- Secondly it is more specific compared to SWOT and PEST. This centers on the fact that this model provides a framework for determining the level of competition in a particular market and how external forces affect a company`s performances.

- Compatibility with other analytical tools is another advantage of this Model. As a framework for external situational analysis, it can be used to further substantiate a SWOT or PEST analysis.

What are the factors included in industry analysis?

Building on the external environmental analysis such as PESTLE analysis, industry analysis focuses on the industry components that can impact business operations. At the heart of the analysis, a ‘balance of power’ is seen to drive competition, as we attempt to identify whether the business is in a strong or weak position within the industry.

The industry analysis components or the ‘five forces’ given by Porter (1980) must be analyzed in detail in order to gain meaningful strategic insights. Therefore, industry analysis factors within each force must be looked at, in order to determine whether these factors can act as sources of threat and drivers of competition.

1. Intensity of competitive rivalry in the industry

This force is used to understand the level of threat exerted by competitors in the industry, which may ultimately reduce firm profitability. High competitive rivalry can arise from several sources such as:

- Low barriers to entry

- High control from buyers and/ or suppliers

- Likelihood of customers substituting the product

- Balance of power among competing firms

- Low differentiation among industry products

- Slow market growth (e.g.: harder to compete in mature markets than developing markets)

- High exit barriers (e.g.: high costs for leaving the industry)

In order to determine the intensity of competitive rivalry, analysts must look at all the factors within the industry that can drive competition between companies (particularly those offering same or very similar products to the same groups of customers).

2. Bargaining power of buyers in the industry

This force is used to determine whether companies can effectively sell their products at high profit margins to buyers in the industry. Note: The buyers in an industry need not necessarily be end-customers (e.g.: buyers of Procter & Gamble products such as shampoos are supermarkets, not household users). Under the prevalence of certain conditions, buyers may possess higher bargaining powers, such as:

- Limited number of buyers in the industry

- Switching costs between companies is low among buyers

- There are a large number of companies competing for buyers

- Possibility of backward vertical integration among buyers (e.g.: Samsung electronics)

Analysts should focus on whether the overall power of buyers can shape the competition within the industry, as high threat from buyers can diminish industry profitability and increase rivalry.

3. Bargaining power of suppliers in the industry

This force is used to understand the balance of power between the supplier and the operating firm, within the industry, which can affect the profit margin of companies. If certain factors are favorable, suppliers in the industry may possess higher bargaining powers, which makes the industry less attractive, such as:

- Limited number of suppliers in the industry (e.g.: due to monopoly)

- Switching costs between suppliers are high (e.g.: due to contracts)

- The supplier brand is powerful, with many customers

- Forward integration by the supplier is possible (e.g.: travel agent)

- Customers are fragmented with low bargaining power

Analysts should focus on how the power of suppliers can affect the companies in the industry and drive competition,thereby pointing out the overall threat level from suppliers.

4. Threat of new entrants to the industry

This parameter is used to analyze the likelihood of new companies entering the industry, which can increase competitiveness, thereby threatening the profit potential in the industry as it becomes less attractive. The likelihood of new firms entering the industry depends on various entry barriers, such as:

- Capital requirement for entry

- Access to distribution channels/ networks

- Economies of scale advantage

- Cost advantage, regardless of size (i.e. via “experience curve”)

- Possibility of retaliation from existing industry players

- Legislative or governmental actions

- Differentiation in the industry

Analysts should focus on the barriers to entry that prevent or promote other players from entering the industry, in order to determine the overall level of threat from this force.

5. Threat of substitute products/ services

This force is used to understand if there is a likelihood for customers to use substitute products (usually from other industries) as alternatives that can suffice their needs. Note: substitute products are not similar products from competitors – instead, they are a different category of products that can offer similar benefits (as an Android phone is not a substitute for an iPhone, but a smart watch or tablet can act as a substitute to a mobile phone). The likelihood of customers switching to substitute products can be gauged by:

- Looking outside the industry for substitute products

- Considering the cost of substituting the product for buyers (switching cost)

- Evaluating the performance and price points of substitute industry products

- Checking the likelihood of customers opting for substitute products (even if it is expensive)

In order to determine the possibility of substitutes threatening the company profitability, analysts must identify the factors that can drive customers towards substitute products.

How to determine industry attractiveness?

The attractiveness of an industry is determined by the relative significant of each of the above factors. If the overall power, threat or rivalry are fairly low, then the industry is considered attractive.

Industry analysis is performed with 5 key questions in mind:

- What are the major forces shaping the competitive environment of the industry?

- What are the underlying driving factors that increase competition?

- Will competitive forces change in the future?

- How are competitors positioned with respect to the competitive forces?

- What strategies can influence competitive forces (such as building entry barriers or reducing the intensity of rivalry)?

An industry analysis framework such the one we have been discussing so far can be applied to answer these questions analytically. We can then use our findings and inferences to plan suitable business strategies.

Industry analysis template

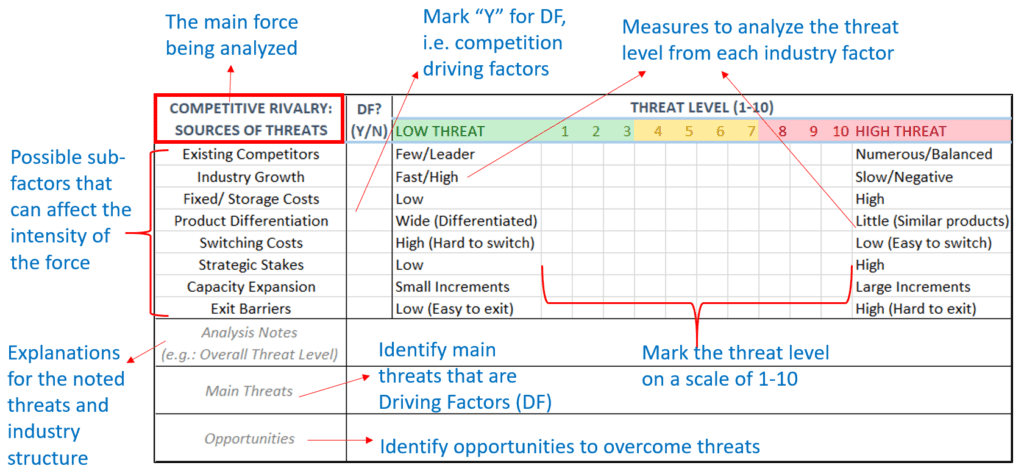

We have developed a sample industry analysis template, adapted from Dobbs (2014) as a free resource for performing in-depth industry analysis.

Sample industry analysis template (customizable)

Five industry analysis templates, adapted from Dobbs (2014), are given below as a free resource to students for performing an in-depth industry analysis. We explain how to use this in the next subsection.

How to use the sample industry analysis template?

There are 5 templates corresponding to the five forces, which share the same format. The components of the sample template are explained below.

- On the top-right is the “title” of the main force being analyzed

- Below the title is a list of 6-8 sub-factors or sources of threats that can drive competition

- The level of threat for each sub-factor is marked on a scale of 1 to 10 (by considering the given metrics/ measures on either sides of the scale, indicating low and high threats, respectively)

- All the major driving factors (DF) for the particular force is marked with a “Y” in the second column (as not all sub-factors may have significant impacts on competition)

- The noted driving factors (DF) is analyzed in the notes section below the table to deduce the overall level of threat from the main force (such as competitive rivalry or new entrants)

- At least 2 main threats are noted in the next row, followed by identifying opportunities that can mitigate the threats (as the purpose of industry analysis is to formulate business strategies)

How to do industry analysis (example of application)

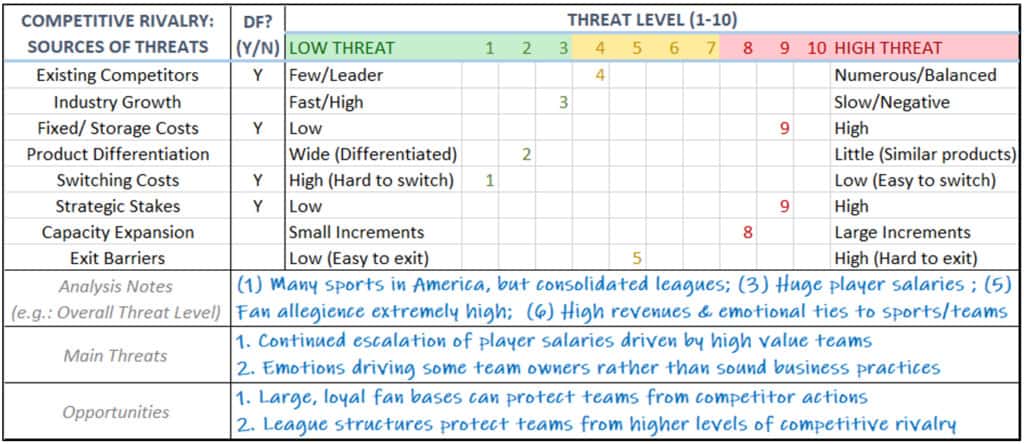

In this example, the competitive rivalry template is used to assess North American spectator sports, where the industry is largely comprised of four major sports (American football, basketball, baseball and hockey), which are played at both major and minor leagues, as well as other team sports (such as golf, tennis and soccer).

The threat level indicator columns are used to assess possible threat sources in the industry that can affect industry attractiveness. For example, four sources of threats are identified as driving factors of competitive rivalry in the industry. The thinking behind the assessment is further explained in the notes section, and subsequently, the key threats and opportunities are also discussed. They can then be incorporated into a SWOT analysis or TOWS matrix, to derive sustainable business strategies.

Note: the level of rigor and documentation in the analysis may vary as the template is customizable. For instance, the analysts can add sources/ citations and quantitative measures such as market volume, industry revenues, etc.

Please refer to our other guide if you’re looking to do comparisons across industries.

References

Porter M. E. 1980. Competitive strategy: techniques for analyzing industries and competitors. Free Press: New York.

Dobbs, M.E., 2014. Guidelines for applying Porter’s five forces framework: a set of industry analysis templates. Competitiveness Review.