Table of Contents

KFC Globalization Strategy

One of the secrets behind KFC’s global success is due to how it adapts its business to different countries and cultures while also standardizing other aspects of its operations at the same time. What this means is that the company standardizes some critical branding and operational aspects of the company, but carefully localizes various other aspects of its business model to adapt to local variables. This is known as a transnational strategy which we have covered in a separate guide.

Adopting such a hybrid strategy often allows companies to bank on advantages from both approaches simultaneously. Localization of strategies can be particularly important for large countries such as China which have a strong culture and local traditions. In fact, China is so large and diverse that there are significant differences in subcultures even within the country. Different regions of China have different local variables that may even be unique to them. We will explore in further detail how KFC has successfully cracked the code while competitors like McDonald’s have struggled.

Before delving into the specifics of how KFC won over China, we need to complete the first step in strategy analysis, which is to explore the internal and external factors that influence the success of a business. Most of the facts and figures presented in this case study are taken from the company’s Annual and Sustainability Reports for 2021.

Overview of KFC in China

How did KFC enter China?

KFC entered China in 1987 through a joint venture with two local partners. One of them was Beijing Tourist Bureau, which held 27% of ownership, and the other was Beijing Food Production, which held 13%. The remaining 60% remained under KFC. This was a time when governmental regulation on foreign ownership in China was still quite strict. Hence, the company had no other option but to partner with these local entities. However, this partnership came with the added benefit of allowing the company access to the connections of these entities within the government which made KFC’s entry in China smooth and successful.

There were some changes made to foreign ownership regulations in the 1990’s which allowed the company to dissolve the joint venture structure. The fact that the company had established a good foothold in the market by then, with a strong distribution network, stores, fleet, and flow of operations, helped it set out further on its own.

What is KFC Called in China?

KFC is called ‘Kendeji’ in China and as one may infer, it is an approximate transliteration using a close pronunciation of ‘Kentucky’. The official name of the company is written as 肯德基 in Chinese (Kěn Dé Ji in Pinyin). This isn’t a literal translation since it is more common for foreign companies in China to adopt the closest phonetical words corresponding to the original foreign name of the company. The actual meaning of the Chinese characters in KFC China’s official is as follows.

| Chinese Hanzi Character | Meaning |

| 肯 | To agree or consent (to something) |

| 德 | Virtue, morality or ethics |

| 基 | Foundation, or basics (of something) |

The choice of Chinese characters by foreign brands is often an effective signal of the company’s values and intended positioning strategy. What we can infer from the meanings of each individual character and their combines meaning is that KFC China aims to invoke a perception of trust and dependability in the minds of local Chinese customers. This is a particularly interesting choice, especially in the light of frequent food safety scandals in the food retailing industry of China, which we shall cover in subsequent sections.

KFC also has an unofficial nickname in China. Some people refer to it as ‘Kai Feng Cai’. This is a play on words as this name is taken from it’s initials, while also represents a popular dish in local cuisine. This another testament to the local association of KFC in China. The company has embraced this nickname in recent times by giving this name to its line of ready-to-cook meals.

Key Facts and Statistics About KFC China

Detailed analysis of various aspects of the company’s strategy, business model and performance in China shall follow in the subsequent sections. However, here’s a quick recap of some interesting facts and statistics about the company’s operations in China.

- KFC’s revenue in China was just over USD$7 billion in 2021

- The company operates 8,500 stores in the country

- It opens around 3 new stores per day on average

- Around 15% of the company’s stores in China are operated by franchisees

- There are 8,500 KFC stores in China, as of 2022

- KFC China sources the materials needed for its operations from 800 suppliers, as of 2022

- Delivery orders typically account for about 20% of total sales

- However, this increased to around 30% as a result of Covid-19

Growth of KFC in China

To say that KFC is ‘popular’ in China would be an understatement. The company has been far ahead of other international fast food retail chains in China since the 1990’s and continues to consolidate its position further. It must be recognized that right from the time of its entry in this market, KFC China successfully positioned its brand as being in tune with Chinese culture. In comparison, the localization efforts of McDonalds’s came a few years after its entry. This was a case of ‘too little, too late’ for McDonald’s as KFC made good use of its 3-year head-start to consolidate its position.

The success of KFC in China is exemplified by the fact that the company opens an astounding average of 3 new stores per day here! What makes this stat even more astonishing is the fact that these numbers are post-Covid!

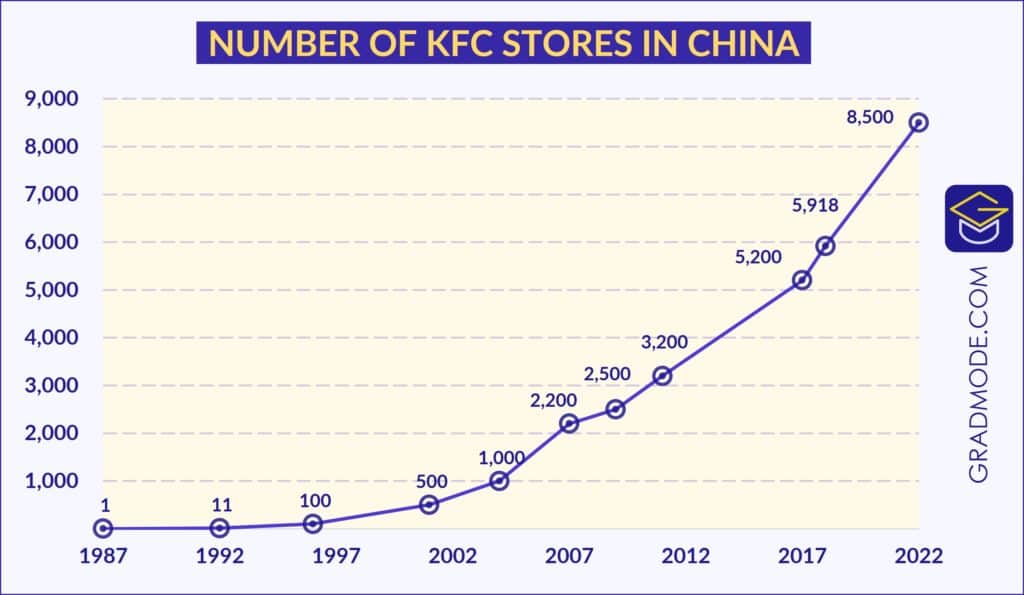

The exponential growth achieved by the company can be better understood by looking at the number of stores under its banner in China. This is illustrated in the graph below. The company started gradually by establishing only 11 stores in its first 5 years of operations in this market. This was then scaled up to 100 stores within a decade. The next few years saw hundreds of stores being added every single year to reach almost 2,500 stores within a 20-year span.

As shown in the graph, the growth took a small hit during the few years following global financial crisis of 2008. However, it bounced back even stronger and hit a period of its highest growth during the next decade. As of the time of this case study in 2022, the KFC operates 8,500 stores in China. In comparison, McDonald’s only has about 4,000 outlets in China, which is barely half the number of outlets as KFC.

KFC China’s operations and profitability took a fairly big hit starting from the first quarter of 2020 due to the Covid-19 pandemic. This led to temporary store closures in many places and even permanent closures in some. During the peak of the pandemic in 2020, KFC had to close nearly 35% of its stores. However, the company has bounced back from this setback and looks to be back on track with its strategic vision of continuing to expand its presence in China by opening even more stores in 2022 and beyond.

Geographic Spread of KFC in China

When evaluating the growth of KFC in China, a key factor that needs to be taken into consideration is geography. Being a very large country, there is a high level of diversity in demographic variables for different regions of the country. The different cities in the countries are often separated by economists into four tiers based on economic growth, gross domestic product and geographic reach.

The Tier 3 and 4 cities often have a lower economic output, which also means that cost of labor would be less. It is also common to see lower populations and different social classes and levels of employment in these cities when compared to Tier 1 and 2 cities. While other foreign brands like McDonald’s have hesitated and stayed away from establishing outlets in lower tier cities due to lower perceived profitability, KFC has ventured and expanded much further in these areas as well. This distinction is also important to consider in the context of KFC’s success in China. More detailed discussion on this shall follow in subsequent sections.

Who Owns KFC China?

KFC China shares the same brand colors and imagery that all branches under the global fast-food restaurant chain of KFC have. However, it operates independently without direct influence or intervention from the branches in other countries. Unlike in other countries, KFC China’s ownership comes under Yum China which indirectly owns the subsidiaries operating the KFC brand in China.

This parent company is incorporated in the state of Delaware in the US. In other words, KFC’s operations in China are subject to the income tax regulations of both the US and China. The company effectively pays an income tax rate of 25% to Chinese authorities, plus an extra 10% withholding tax on the earnings which it repatriates out of the country (to its parent company). In contrast, companies which operate mainly in the US are subject to a flat corporate income tax rate of 21%.

However, not all stores in China are owned and operated directly by Yum China. Approximately 15% of the company’s stores in China are operated through franchising agreements with channel partners. KFC makes money from its franchisees by receiving both upfront franchise fees as well as on-going royalties such as a percentage of their sales.

KFC China Food Safety Issues and Scandals

KFC China has had its fair share of food safety issues and scandals over the years. In 2012, the company lost a lot of sales revenues due to a scandal related to claims that it was using antiviral drugs and growth hormones in its chickens. As this was in violation of food safety laws, the government launched a detailed investigation covering the use of antibiotics in food items.

The company had to fight an uphill battle to restore both consumer and government trust in its brand. KFC China also faced some controversy over food safety standards in 2015 when one of its suppliers was shut down due to claims of supplying expired meat. These kinds of issues increase consumer resistance towards the company, especially seeing as it is a foreign brand, a fact which invites additional scrutiny and concerns over trust in China.

SWOT Analysis for KFC in China

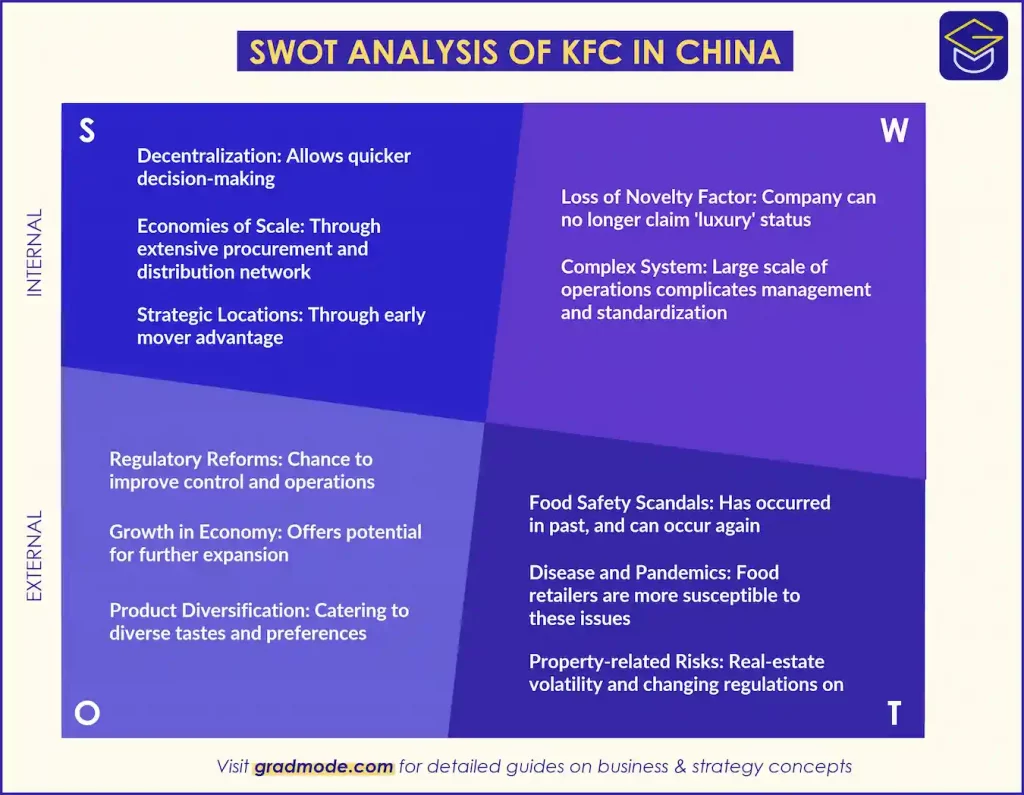

Based on our KFC China SWOT analysis, we have identified some key points that play a significant role in the company’s continued success in China.

Strengths

Due to its adoption of the transnational strategy, the company benefits from using a well-established and recognizable global brand, while also reaping the rewards of adapting various elements of its business to suit local consumption patterns.

Another strength gained by the company solely due to this strategy is the fact that it does not need to look to management of the parent company in the US for decision-making. This allows the company to make quicker adjustments to capitalize on local trends.

The company has a key strength in procurement thanks to its strong presence in the country. Having so many stores in the country gives the company significant buyer power which often provides it the upper hand in negotiations with suppliers. The company has benefited even further in this regard through the central procurement model of its owner Yum China which also had other major restaurant chains such as Pizza Hut and Taco Bell under its banner.

The type of product which the company specializes in also gives it an edge over competitors like McDonald’s or Burger King. Fried chicken is a more generic and relatable product for Chinese customers as compared to hamburgers, which are obviously more alien to Chinese traditional cuisine.

Apart from price negotiation through high volume of purchases, the consolidation of the procurement function also gives the company an easier way to manage its extensive supplier network with better quality control and standardization measures.

The company has also managed to secure strategic locations for its stores which give it access to a greater level of footfall and customer traffic. This strength can also be traced back to the company’s first-mover advantage of being one of the first foreign food retail brands in the country. The company’s early entry to the market allowed it to lock-in prime locations before they competition became too high.

Weaknesses

KFC no longer has the novelty factor which it used to have during its initial introduction to the country. Additionally, its excessive focus on localization of menu choices makes it more difficult for the company to stand out amongst a sea of local, home-grown restaurants.

The huge network of stores which the company has in China can be as much of a liability as it is a strength since it needs to invest more time and resources into managing this network. This is especially necessary when overseeing the operations of franchised stores and ensuring that they match the standard brand values of the company.

Opportunities

The changes to the ownership regulations in China in the 1990s was one of the first opportunities that the company immediately capitalized on. While the company had entered the market in a joint venture with local partners, it used this chance to dissolve the joint venture and consolidate ownership. This helped the company with faster and more efficient decision-making.

Another opportunity for the company in this market the relatively lower competition in lower tier cities since other foreign brands were predominantly focused on urban areas. The companies to make effective use of this opportunity to date as evidenced by the exponential increase in the number of stores year after year.

The size of the country and it’s population, combined with the fact that it is a growing economy with increasing disposable wages and less market saturation all provide a good climate for large companies to invest and grow rapidly. KFC has benefited greatly from these trends as part of its market penetration strategy, and the continued increase in its number of stores in the country is further proof of this.

The large size of the population and diversity in cuisines and tastes between different region also provide an obvious opportunity for market expansion through product diversification. KFC China also makes very effective use of this opportunity, as we shall cover in subsequent sections.

Threats

Food scandals and claims of contamination, adulteration or even diseases being spread through the operations of food retailers is a fairly common occurrence in China. This poses a major threat which can damage the trust in the brand. An isolated incident in a local area can have a significant negative impact on how the company is perceived across the country. In fact, KFC has already faced issues with foodborne diseases such as E. coli, Hepatitis A and Salmonella in its supply network. Another scandal took place in July 2014. The Chinese authorities closed restaurants in Shanghai following rumors of using expired meat. The brand broke the contract with their current supplier and tried to fix their good reputation.

The spread of diseases such as the Covid-19 pandemic in recent times or the African Swine Flu prior to that all have larger impacts in the food retail industry than in other sectors. The impact may not just be a disruption to operations; it might affect the profit margins directly. An example of this is how the price of protein and poultry went up drastically in China in 2019 due to the spread of the African Swine Flu.

It is important for the company to keep a tight control of its supply chain quality and effectiveness to protect itself against scandals and bad publicity. Negative incidents in the supply chain are especially harmful in the food retailing industry due to the direct impact that it has on health and safety of the consumers. KFC China has had some bad experiences in this regard, such as the failure of some of its upstream poultry suppliers to comply with the company’s established standards.

During the pandemic, many provinces had put tough measures in place to discourage travel. This was especially enforced during period of holidays, such as the Chinese New Year holiday in 2022. This was a tough pill for the company to swallow since holiday season is often the most profitable time of the year for the company. This was set against the backdrop of the fact the company had already suffered significantly due to operational restrictions caused by the pandemic.

The fact that the company leases nearly 8,500 properties in China opens the door to a lot of uncertainty. This includes various factors such as swings in the real-estate market and disputes over property ownership and inheritance which could disrupt store operations. Additionally, the company faces a huge risk since the Chinese government has the authority to obtain ownership and control of any land plots and the buildings which it considers to be in the interest of the public. There is usually no legal provision which the tenant can use to even claim compensation.

Another operational risk faced by the company arises from the fact that it deals with a large amount of cash as a part of its day-to-day operations. This opens the company to instances of fraud, theft and other forms of misconduct which are often difficult to detect and prevent.

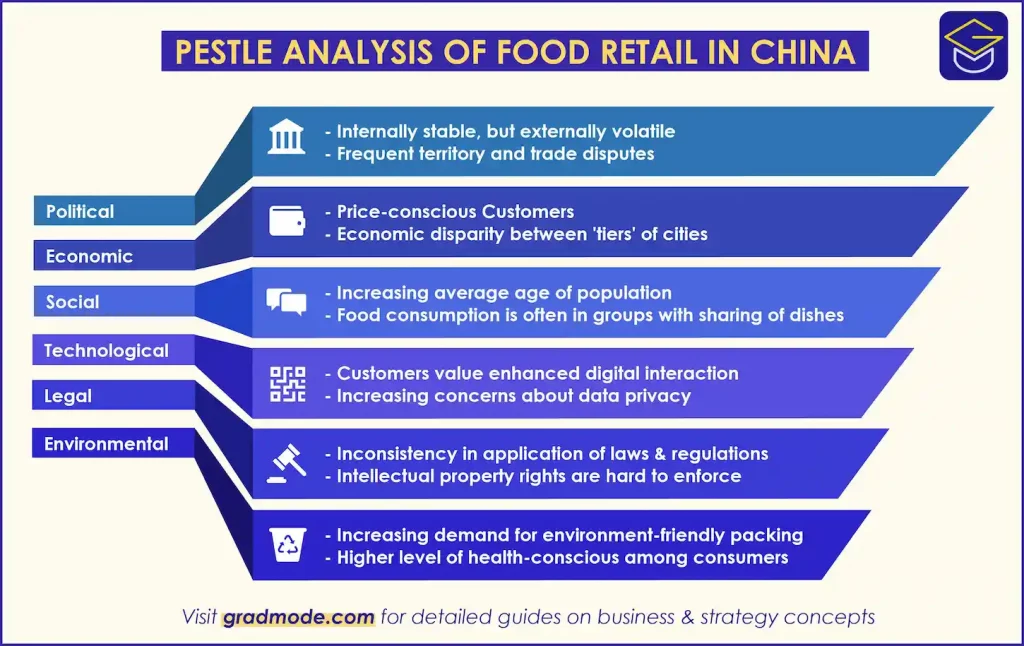

PESTLE Analysis of KFC in China

Here’s our summary of the key points of external environment of KFC in China, using the PESTLE analysis tool. Detailed discussion of these points can be seen in the relevant subsections below.

Political

The internal political environment of China is quite stable in terms of the party in power making the legislations. However, the government in known for making new sweeping changes on short notice. Often, the interpretation and application of new regulations is not clearly set out and there could be differences in enactment at local government levels. This element of uncertainty has a strong impact on KFC’s revenue in China. As we’ve mentioned before has spread out and expanded to the various tier levels in China which means that the company also has to deal with different local jurisdictions and administrative departments as well. Exposure to this level of uncertainty poses some difficulty to the vision of standardization which companies like KFC aim to achieve for better efficiency in operations.

On an international level, the situation becomes more difficult as the country often has soft escalations with both neighboring countries and those in the West, especially the US. For instance, the political tensions between China and US in 2020 led to various new policies being enacted by the Trump administration which affected businesses operating in China. Some specific examples include the Clean Network program which was launched with an aim of protecting U.S. telecommunication and technology infrastructure and the banning of transactions through certain software and applications which were associated with China. The list of banned applications included popular payment gateways such as Alipay, QQ Wallet and WeChat Pay. This was detrimental to operations of companies offering these payment options, including KFC for which sees a significant portion of digital orders and digital payments. In 2021, digital orders accounted for around 86% of total sales, and digital payments and mobile payments contributed to about 98% of total sales.

Despite all its efforts to come across as a brand which is well in-tune with local customs and traditions, there is no escaping the fact that the company is a well-recognized global brand originating in the West, and US specifically. This has created problems for the company in the past, such regional protests and boycotts from some segment of customers in China in the aftermath of political disputes regarding the claims of territories in the South China Sea.

Economic

Historically, the culture and traditions of Chinese consumers has encouraged them to pursue to long-term savings and makes them sensitive to price. Often, this mindset also leads them to seek out the best deals and promotions. More recently though, Chinese consumers are starting to show higher levels of individualism in their buying choices and are less price-sensitive compared to before. However, they are still more price conscious when compared to their counterparts in Western countries.

The tier system discussed in previous sections also points to an economic disparity across the country. Different regions are characterized by different levels of income and standard of living. Such differences in socio-economic backgrounds of consumers have implications on the type of products and price points that appeal to them. At the same time, it also represents differences for KFC in terms of the labor market which they can draw talent from.

Social

Chinese consumers are found to be more willing to pay a higher price point for products that are perceived to be novel and foreign. This may have been the factor which guided the strategy of McDonald’s and other similar foreign brands to not localize their business as much as KFC did. The mistake in calculation of these other companies, and where KFC has done well, is that the novelty factor wears off soon unless products are being constantly innovated. In fact, the company is so good at keeping this novelty factor that it has invested resources in remodeling its stores regularly. In 2022, the company reported that nearly 78% of its outlets in China were remodeled or built in just the previous five years.

In terms of demographics, it is safe to conclude that the younger generation of customers often find fast-food brands such as KFC more appealing than older age groups. KFC has done well to make itself especially appealing to different target segments such as youth, rising middle class, teenagers, and college students. It has achieved this by choosing its marketing and advertising strategy carefully. Often, the company’s commercials show KFC products being shared in social settings and depicting KFC Stores as places where people can gather socially. The impact of this positioning strategy is noticeable in the fact that many Chinese eat KFC for Christmas as a social tradition, although perhaps not to the extent that this practice is common in Japan.

In recent times, the age structure of consumers in China has changed significantly. The one-child policy has led to a significant decrease in the fertility rate of the country. This has led to an increase in proportion of the older population segment. When combining this factor with the previous identified one about stronger preference for KFC from younger customers, the implication is obvious.

KFC can expect to see a proportion decline in its revenue as the average age of customers in the country increases further. However, against this background, the company has also done well to diversify its customer base through increased menu options and this another factor we shall touch upon in subsequent sections of this case study.

Technological

Technology has become increasingly accessible in recent times, and this is no different for the Chinese market. Many consumers in China are starting to show a preference for enhanced shopping experiences through greater digital interaction. The broader access to technology and the increasing trend of online shopping also contributed to this. This factor is noticeable through the fact that nearly 86% of the company’s total sales in China in 2021 were through digital orders. KFC China also relies on digital R&D centers to support its technological capabilities and capture customer value better. Three new R&D centers were established in 2021 alone.

The digital presence of KFC China is strong enough that it can run a massive loyalty program with 330 million members (this user base is shared with other brands under the Owner Yum China). This allows the company to reap the rewards in the form of higher order frequency and customer loyalty.

KFC China also uses a sophisticated artificial intelligence algorithm called the “Super Brain,” which combines and integrates data gathered through everyday store operations. This data is analyzed to improve the decision-making capability of the restaurant managers. The company has even experimented with proprietary smart watches and smart glasses to closely monitor the real-time operations and process flows. This is supposedly for the purpose of making suitable adjustments to staff schedules and improve management efficiency.

On the flip side, such an approach does pose various questions in terms of data privacy and excessive monitoring of personnel. One might expect similar resistance to the use of facial recognition data by business to provide new services. China is one of the early adopters of the application of facial recognition technology for mobile payments and it has since become commonplace. While acceptance of this technology was rapid in the early stages, consumer resistance has been growing in recent years. Such kinds of reactions by customers affects how well KFC China can undertake digital transformation efforts in the country.

Legal

In China, there are several food-safety laws which lay down detailed guidelines and rules for food safety assessment, standards, production, inspection, and distribution. In the wake of several scandals in the supply chains of different players in the food industry, violations of established regulations often draw financial, administrative, or even criminal penalties. KFC has been on the receiving end of such sanctions on multiple occasions. However, it is a testament to the popularity of KFC in China that such scandals have failed to make a significant negative dent on the company’s presence in the country.

While we touched upon increasing adoption and advancements in terms of technology in the previous section, this is accompanied in parallel by an increase in regulatory measures in the areas of information security and protection. The laws and requirements covering data privacy and cybersecurity have been tightened in recent times.

It is also worth noting that the laws in China do not always offer the same type or extent of protection which is expected and even taken for granted in the US. This is particularly true in the field of intellectual property rights. Apart from vagueness in the coverage of these rights, there is also a noticeable inconsistency in the enforcement of these laws at different levels of government and across different regions of the country. In fact, there many restaurants in the country which use imagery imitating established brands such as KFC and McDonald’s, seemingly without legal repercussions.

Environmental

A key environmental factor of importance in China is the increasing awareness about the negative impact of non-sustainable and single-use packaging. Going back to the point of long-term orientation, which is emphasized in traditional Chinese culture, generation of unwanted wastes is highly discouraged. KFC China has tried to overcome this by gradually replacing some of its plastic packaging with paper-based and biodegradable alternatives.

The company claims that it reduced nearly 9,300 tons of plastic waste and 4,320 tons of paper waste in 2021. However, this is a measure that nearly every other competitor has also announced as taking, so it does not distinguish the company from others. There is definite room for innovation in this regard which can further cement the company’s popularity in the country.

There is also an increasing awareness of and demand for better nutrition and healthier product choices from consumers in China. To cater to this trend, KFC China opened some specialty stores promising to deliver on a healthy concept model. This was done under the ‘K Pro’ brand, which was launched in 2017. In place of items which used fried chicken, healthier alternatives such as salads, paninis, and juices.

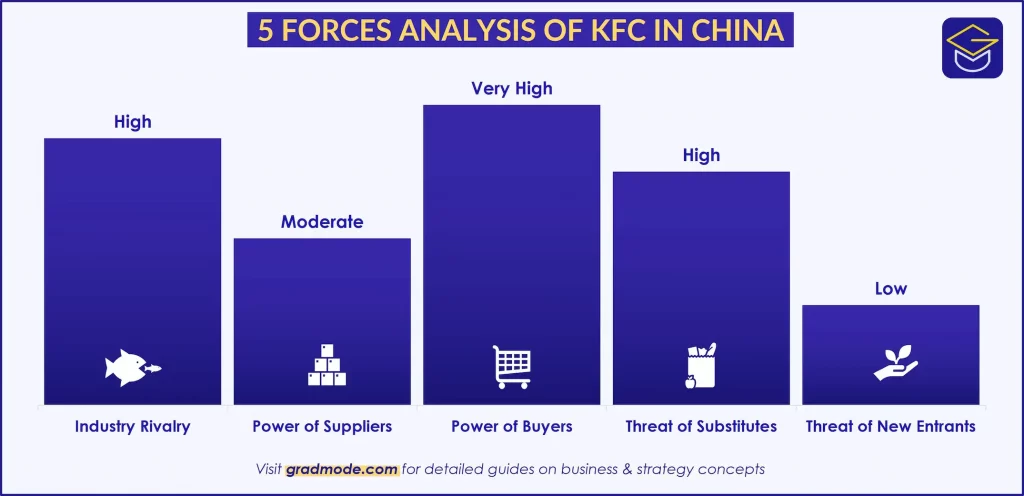

Porter’s Five Forces Industry Analysis of KFC in China

We have analyzed the food retailing industry in China based on Porter’s five forces model and summarized it in the figure below. Please read the detailed discussion of each of the factors to better understand the logic behind our assessment.

Industry Rivalry (High)

The main foreign brands which represent a higher level of industry rivalry for KFC China are McDonald’s, Burger King and Domino’s Pizza. Pizza Hut and Taco Bell are other foreign brand competitors, but they do come under the same parent company as KFC China (Yum China).

Some local Chinese fast-food competitors include chains such as Daniang Dumpling, Kungfu, Zhen Kong Fu and Malan Ramen. These have seen an increase in popularity in recent years. However, a factor that works against these local chains is that they do not often gave the benefit of standardized cooking methods and ingredients that KFC China does due to the incredible efficiency of its operations. There are also Asian brands like Home Original Chicken, Hua Lai Shi and Dicos which offer American-style dishes such as burgers and chicken nuggets, often at cheaper prices.

Apart from strong competition from these large foreign and local chains, the rivalry in the industry is further intensified by the convergence in grocery, convenience, deli, and restaurant services. As such, industry rivalry in fast food retailing in China is considered to be high.

Bargaining Power of Buyers (Very High)

With fast food restaurants, the obvious factor which gives more power to the buyers is the lack of any effective switching costs. In recent times, companies have tried to increase their bargaining power by offering membership and loyalty programs. In fact, KFC China’s loyalty program is quite large with nearly 330 million members, as we have covered previously. There is also a significant overlap between the menus and specific food items between the different options in the market. This also results in better bargaining power for the buyers. As such, we consider the bargaining power of buyers in fast food retail in China to be quite high.

Bargaining Power of Suppliers (Low)

The SWOT analysis of KFC in China in the earlier section established the fact that company enjoys a stronger hand in price negotiations with its suppliers due to its high-volume purchases and centralized procurement model. While the growth of the company’s scale of operations and number of stores is accompanied by a similar increase in the number of local suppliers, the proportion for the two increases has not been the same.

While the number of stores nearly tripled in the decade between 2010 to 2020, the increase in the number of suppliers was less than double (from around 500 in 2010 to about 750 in 2020). This comparatively lower increase in the number of suppliers can be taken to imply a much stronger position for the company during negotiations with suppliers. As such, the bargaining power of suppliers is evaluated as being low.

Threat of Substitutes (High)

As identified in the PESTLE analysis of KFC China in the earlier section, there is a growing trend of health-consciousness among consumers in China. This drives up the demand for substitutes which are healthier food choices for the customers. KFC seems to be fighting this threat by offering healthy seasonal vegetables in its menu. It’s K Pro is also an attempt to directly tackle this threat.

While the ‘fast-food’ concept does stay true to its name and offer a quick turnaround between making an order and getting the food, there is an even faster substitute that fast-food companies need to be weary of. In China, many convenience stores and even groceries have a section of food products which were pre-packaged earlier in the day or just the previous day. This represents a good substitute option for the working population seeking to get a quick lunch while avoiding the queues at restaurants. KFC China’s launch of KaiFengCai series of ready-to-cook meals can be seen as a way for the company to expand further into what were previously substitutes. Overall, the threat of substitutes is considered to be moderate to high.

Threat of New Entrants (Low)

The cost of entering this market in China is fairly high with significant investments being required to establish the necessary infrastructure, stores, distribution network, food safety certifications etc. This makes it difficult for new entrants to come and challenge the major established market players. Having said that, the threat of new entrants for food retailers in China mainly comes from new forms of product distribution and delivery.

In recent times, China has seen an increase in the number of food delivery aggregators, and new forms of food retail and delivery services such as ghost kitchens, cloud kitchens and shared kitchens. These new entrants often hold a high novelty factor and try to offer a wider range of cuisines and novelty dishes which can pull customers away, especially in urban areas. As we have covered in previous sections though, the novelty factor is one that often wears away quickly, and this has been observed in the food retail sector in China in the past. Hence, the threat of new entrants is considered to be somewhere between low to medium.

KFC China Localization Strategy

General Overview of KFC China vs US

The most important feature of KFC’s localization strategy in China is its significant commitment to embracing the local culture through targeted adaptation efforts. This is most noticeable in terms of the menu options offered in its outlets in China as compared to the US.

It works in the company’s favor that Chinese customers perceive the company as being better than the average fast-food store. It is not considered a ‘cheap’ dining option, which is often the association that most fast-food chains including KFC have in other markets. Instead, the customers place it somewhere in between casual dining and fine dining. This is entirely down to the company’s transnational strategy of combining its globally recognizable branding with localization at nearly point possible.

Another difference between the two countries is in the style of cooking. In China, boiling is the more preferred technique of cooking rather than deep frying. There are also differences in Chinese table manners compared to the US, ranging from obvious aspects such as the usage of chopsticks to more obscure differences such as the general approach to consumption of food. Chinese consumers frequently gather to sit together and eat in comparatively larger groups than in America. KFC China offers a greater variety of choices in its menu as compared to KFC in America and this is better suited to the local trend of eating food in larger groups because these customers like to order and share several dishes with each other.

Whereas consumers in the US may hesitate in consenting to the use of facial recognition technology, Consumers in China area already used to this, as identified in our PESTLE analysis. Despite some resistance to the use of such technology emerging in recent times, this application of technology does not appear to be going out of trend in China in the near future. This is another difference in the digital presence and user interaction aspects of KFC in China vs America.

Another distinction is that the company focuses mainly on chicken-based products in North American markets. In China (and several other markets) the company also offers beef and pork products. However, it is worth nothing that the company’s focus on chicken gives it another edge over McDonald’s because Chinese consumers show a greater preference for chicken compared to beef (which McDonald’s has a greater focus on).

Localization of Menu Options

As we touched upon several times in earlier parts of this case study, localization of the menu and available items to suit local tastes and preferences is the cornerstone of KFC’s strategy in China. The staple food items consumed by a lot of people in China are rice, porridge, and noodles. In comparison, consumers in the US and other Western cultures show a greater preference of bread and wheat-based items as their main source of nutrition. KFC China has paid attention to this factor and various other local tastes and preferences and carefully adapted a localized menu which must be recognized as a critical success factor for the company. Here are some localized items which are available in KFC China but in the US and most other markets.

- Matcha Ice Cream

- Soy Sauce Chicken

- Sandwiches With Prawns

- Soymilk Drinks

- Chicken Tendon Skewers

- Fried Dough Savories

- Rice-Based Meals

- Fried Dough Sticks

- Egg & Vegetable Soup

- Chilli Beef Pancake

- Dragon Twister

- Grass Jelly Milk Tea

- Shrimp Burgers

- Egg Custard Tarts

- Fish Ball Soup

- Soup Dumplings (Xiao Long Bao)

- Fried Donut Stick (Youtiao)

- Beef Noodles

- Seasonal Vegetables

- Bamboo Shoots

- Lotus Roots

- Tree Fungus Salad

- Pickled Chinese Cabbage

- Smelly Tofu

- Skewered Meat

- Preserved Eggs (Cantonese-style Pidan)

However, the company has not abandoned its conventional Western-style products altogether. It does offer them in parallel since the perception of a certain level of foreignness is what allows the company to charge a higher price point than local competitors. This is also part of the hybrid transnational strategy that we explained at the beginning of this case study.

KFC China even localizes products for different regions and provinces within the country based on local tastes. For instance, its products in Shanghai are less spicy compared to its menu in Sichuan and Hunan to better suit local preferences in each of these regions. Similarly, the company also added Wong Lo Kat herbal tea to its menu only in the Guangdong provide as this is one of the oldest brands of herbal tea which is widely popular in this region.

The company’s commitment to localization of its menu items runs so deep that the company has even established its own seasoning facilities. To ensure the authenticity of its flavors, the company also makes use of traditional Chinese spices including aniseed, Chinese cinnamon and sesame oil.

The company has also set up a massive 27,000 square-foot ‘innovation center’ in Shanghai which focuses on coming up with new recipes, cooking methods and menu items. The company has also set up a food advisory committee to lobby for support in its favor. KFC China also began selling a range of products branded as ‘local street food’ in 2019. This included options like chuan, boiled skewers.

Apart from introducing local menu items, the company also fuses some dishes together to introduce more innovative and partly localized products. One of its new additions is prepared similar to the traditional dish known as Peking Duck with chicken being substituted instead. This dish also makes use of sweet sauce that is made using fermented flour as this is the condiment used in Peking Duck.

It is worth noting that KFC China has made a conscious decision to not completely localize its menu options and give up its foreign brand status completely. Instead, the parent company of KFC China spun off a completely new brand known as Dongfang Jibai (which means East Dawning) based on the business model of KFC to exclusively serve Chinese Food.

Localization Aspects in the Supply Chain

As we had covered in our earlier KFC China SWOT analysis, a key strength of the company is its central procurement system through which group sales are centralized. This provides several benefits such as better management and control of the supply chain, while also putting the company in a better position to protect against food safety issues and scandals which were a key threat identified for this market.

For the most part, KFC China sources its chicken and other necessary materials locally. Its network of nearly 800 local independent suppliers account for almost 90% of the requirements of the company. Due to the large scale of the company’s operations, it has a dedicated team of almost 1,400 employees who are focused solely on supply chain management activities. However, their roles within the supply chain system range from safety, quality assurance, and procurement management to delivery, logistics, and even engineering.

The company has also invested heavily in integrating its logistics in China, which is evidenced by ongoing acquisition of properties to establish new logistics centers, with 3 new hubs being set up just in 2021. The company also relies on its network of 32 logistics centers which it operates in close coordination with independent distributors to move material and products around the country.

The company has also put in place agreements with local delivery aggregators to have their products listed on and ordered through their respective platforms. This further expands the sales network and reach of the company.

Localization of Store Design

The company also localizes its store design and undertakes frequent remodeling to ensure that it is staying in tune with customer expectations and local trends or preferences. As we mentioned earlier, almost 78% of KFC China stores have been remodeled or built between 2017-2022. Other examples of the company’s localization in terms of store design include themed restaurants which focus on certain specific aspects of Chinese culture.

As part of localization of store designs, KFC China set up some themed restaurants in partnership with the National Museum of China and the Palace Museum. This collaboration granted KFC the rights for usage of imagery and interactive displays of historical and traditional Chinese culture and artefacts in selected stores. Another example is a restaurant in Chengdu which has a distinct theme which recognizes the contributions of the poet Du Fu who was a native of this city.

Apart from localization of aesthetic elements in its stores, some other store design choices of the company also seemed to be well-suited to this market. For instance, we identified in the PESTLE analysis that Chinese consumers are increasingly technology-savvy and are also becoming more conscious of environmental impacts. The company’s decision to trial some pilot projects in which photovoltaic panels were installed in its stores to generate solar energy also capitalizes on these trends.

Some other distinct store decorations used by the company include placement of Cantonese-style redwood palace lanterns in its stores. The company also updates the theme and design of its stores with special decorations for certain occasions, such as the Chinese New Year and other traditional festivals.

Having covered localization of store design, it is also worth pointing that KFC brought over something from other markets, which was new to China. This was the inclusion of toilets in its facilities, which were also air conditioned. During the early years of the company’s operation in the country, such kinds of amenities were not common in public spaces and definitely not within local restaurants. This helped the company cultivate an image of luxury during its early days, although it has repositioned as a value-for-money option in recent times.

Variation in Pricing

As we identified earlier, Chinese consumers are typically more willing to pay a higher price for the products which they perceive as novel and foreign. This has allowed the company to charge a higher price in China as compared to other markets.

Overcoming Consumer Resistance

It was identified in our PESTLE analysis of KFC China that Chinese consumers are more sensitive to price. Compared to the US where KFC and other fast-food chains are already considered good ‘value-for-money’ options, KFC China charges a higher price point, as we have also mentioned earlier in this case study. Comparing these two points, it can be inferred that KFC China faced a greater value barrier of convincing consumers in China that its products still represent better ‘value-for-money’ for them when compared to other foreign and local brands.

Overcoming consumer resistance often requires educating consumers. In this regard, KFC is often quick to act on issues related to food safety standards and denounce outlandish claims such as the rumor that it was using ‘mutated’ chickens. In the wake of an earlier scandal, the company even put out a message on the paper placemats in its stores highlighting the steps that it was taking to ensure food safety in its supply chain. This proactiveness has allowed the company to weather the storm and recover fairly quickly from temporary drops in market value when such scandals come up.

Another strategy which the company uses to overcome consumer resistance is to focus on community development as part of its corporate social responsibility efforts. It seems to be picking and choosing specific initiatives which paint is as a part of the local community, instead of being just another foreign brand.

The KFC SWOT analysis in an earlier section of this case study revealed that Chinese consumers are becoming more wary about the incursion of technology such as facial recognition. Since the company makes use of this technology at the moment in many of its stores (even claiming that due to ‘positive feedback’, they have expanded this option to 1,600 KFC restaurants across China in 2021), it would do well to pay heed to changing trends and make adjustments to its services accordingly.

Concluding Remarks

This case study of KFC China’s success shows how the company has adapted its overall strategic outlook with locally driven tactics to consolidate its position in the market.

KFC China’s localization strategy has been comprehensive, starting from tangible elements like products (in the form of a locally driven menu) and store design (such as its themed restaurants and frequent remodeling), and extending to intangible elements such as payment systems (through the support of various local payment providers and facial recognition for payments) and advertisements.

Another thing that stands out is that KFC China expanded rapidly, yet organically to ‘lower tier’ cities, whereas competitors like McDonald’s hesitated, perhaps due to the perception of lower economic value. The fact that KFC expanded to the lowest tier of cities often means that it is the first foreign brand that residents of those localities experience. This continues to provide first mover advantage to the company, even to this day.

The market share of KFC China has remained high over the years. It is clear that China loves KFC, and that the company’s unassailable lead will hold strong for many more years to come. Even various food scandals over the years have failed to put a dent in the reputation and population of KFC in China.

In conclusion, the company’s strategy in China is an exemplary case study on the benefits of transnational strategy and how to execute it well.

<Disclaimer: The company logos used in this case study are registered to KFC>