The difference between SWOT and TOWS analysis is that the former identifies internal and external factors. The latter expands upon this by interlinking the identified factors to assess the strategies available to companies. In other words, TOWS is used to align the strength and weaknesses of a company (internal factors) to the opportunities and threats that exist in the environment (external factors), to gain a better understanding of the current and future strategies of a company. Hence, SWOT analysis is often the initial step before doing TOWS analysis.

Here is a detailed list of specific differences between SWOT and TOWS.

| Basis of Difference | SWOT Analysis | TOWS Analysis |

| What does it help with? | Capture a snapshot of the company by evaluating internal resources and assessing the external environment | Gain a better understanding of the current and future strategies of the company |

| What does it focus on? | This is an assessment of how well a company is matching its resources to the business environment which it is competing in | This is an assessment of what strategies are available to a company based on its resources and factors of the environment it operates in |

| What do you need to do? | Brainstorm and identify internal factors (strengths and weaknesses) and external factors (opportunities and threats) | Try to align internal and external factors of SWOT which have been identified to categorize the strategies of companies |

| Is there a sequence to follow? | SWOT analysis can be done directly by looking at internal factors of a company and external environmental factors | TOWS analysis is only possible if we have already identified a list of strengths, weaknesses, opportunities and threats to work with |

For a more thorough explanation of each of these tools, please go through the next sections as well.

Table of Contents

What is SWOT Analysis?

SWOT analysis is an overview of the strengths and weaknesses, which are internal to an organization, along with the opportunities and threats, which exist in the external environment and can impact business decisions.

It needs to be mentioned that internal and external analysis exercises should not be confined to just painting an overall picture of the company and its environment. This is a point that a lot of students seem to miss. Instead, it is the interplay between individual factors in the internal and external environments which gives rise to different strategies. This is where TOWS comes in and helps take SWOT a step further in terms of analytical thinking.

What is TOWS Analysis?

TOWS Matrix Definition

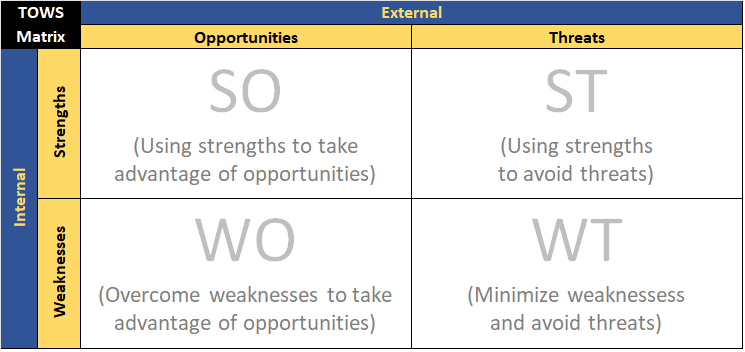

TOWS Analysis refers to the interlinking of the internal strengths and weaknesses of a company with the threats and opportunities that it faces in its external environment. It is a categorization of the strategies which are available to a company. It does this by focusing on aligning internal elements with external factors in an appropriate manner. To help with this analysis, a visual representation is often used. The following image an example of a TOWS matrix illustration.

You can download our free TOWS Matrix template from our resources page.

TOWS Matrix in Strategic Management

When conducting TOWS analysis in strategic management studies, you will need to apply some critical thinking to align what you know about the company with whatever relevant information is available about its environment. As this is easier said than done, we shall explain how to do a TOWS analysis by presenting a TOWS matrix example of Apple in the subsequent sections.

If you want to learn how to approach strategy analysis in the same way as we have done, please check out our guide on how to apply critical thinking in strategic management.

Strategies Combining Strengths + Opportunities (SO)

The intersection of strengths and opportunities should be a key indicator of what companies need to focus on to succeed. It shows the areas where there is an overlap between internal strengths of the company and external opportunities in the market. In other words, SO strategies are avenues for developing strong competitive advantages.

Example: Apple has strong brand awareness and loyalty from its customers. It also has strong capabilities in product design and aesthetic. Combining these factors (which are internal strengths) with the growing popularity of touchscreen smartphones (a good market opportunity) is what to led to the launch of the first iPhone. This was of course, an immediate and massive hit, breaking various records for phone sales at the time. We explain these kinds of synergy between internal departments in further detail in a separate post.

Strategies Combining Strengths + Threats (ST)

This is a situation in which a company possesses some strengths but there are factors in the external market which pose a threat to the company, which restricts the use of these strengths. The aim of strategies which can be categorized in this section is to make use of the available strengths to navigate around the threats in the environment.

Example: As mentioned earlier, some of the core strengths of Apple are its product design and strong brand loyalty which it commands from its consumers. It has taken advantage of these strengths to push the use of its proprietary lighting cable connection on iPhones and iPads. This boosts its revenue while most other phone manufacturers have already adopted Type C as a standard connection for their devices. However, Apple faces a threat in some markets like the European Union where the local regulators are pushing for the company to also adopt Type C in its devices to reduce unnecessary electronic waste. Adopting the Type-C standard might potentially lead to a partial loss of revenue for the company. However, by properly using its strength in product design and capitalizing on brand loyalty, a sizable portion of its consumers will continue to buy Apple’s Type C charger rather than cheaper alternatives.

Strategies Combining Weaknesses + Opportunities (WO)

This is when a company has some weaknesses in a certain area but there happen to be viable opportunities in the market which require expertise in that area. Strategies that are in this category are those that focus on overcoming the weaknesses of the organization to take advantage of the opportunity.

Example: Apple typically has a comparatively smaller product portfolio compared to its competitors, and this is one of its few weaknesses (although this may be arguable). When new opportunities arise in the market in the form of the latest trends, Apple is not always the quickest to capitalize on it. However, the company has still made good use of WO strategies in its ascent to commercial success. The wearables sector first started gaining traction in 2010 and this represented a strong market opportunity. Competitors like Google, Samsung, Motorola had all launched gadgets in this space in the next few years and were seeing returns. Apple then overcame its weakness and entered this market with its Apple Watch in 2015, which proved to be a success.

Strategies Combining Weaknesses + Threats (WT)

The strategies that come under this category are those that aim to minimize the impact of threats which the company faces while also overcoming the negative effect of internal weaknesses. As you can tell, these kind of strategies are usually defensive in outlook. They seek to protect the company from being overrun by competition.

Example: Apple has been in the digital media sector since the launch of its Apple TV device in 2007. However, despite updating this device over the years with several upgraded versions, it was not a commercial success. The weakness it had in this area was mainly due to limited functionality and interconnectivity compared to competing products like Roku or Fire Stick. This was because you needed to already be in the Apple ‘ecosystem’ to make full use of the device. At the same time, the threat in the digital media space was growing day by day with more and more streaming service launches. The introduction and launch of its own streaming service (Apple TV+) is a WT strategy. This is because it helps the company reduce its weakness and overcome the growing threat to a certain extent.

Concluding Notes

In conclusion, SWOT is mainly a tool for internal analysis even though it does have external elements of opportunities and threats. On the other hand, TOWS has more of an external emphasis while also taking into account internal factors. If you’re looking for a tool that has a complete external focus, you can read our guide on industry analysis in strategic management. Alternatively, you can also review our guide on other internal analysis tools a more comprehensive understanding of other alternatives for examining the internal environment of companies.